AI-powered CBAM compliance at scale

Master CBAM Reporting and Safeguard Your Margins with carbmee EIS™

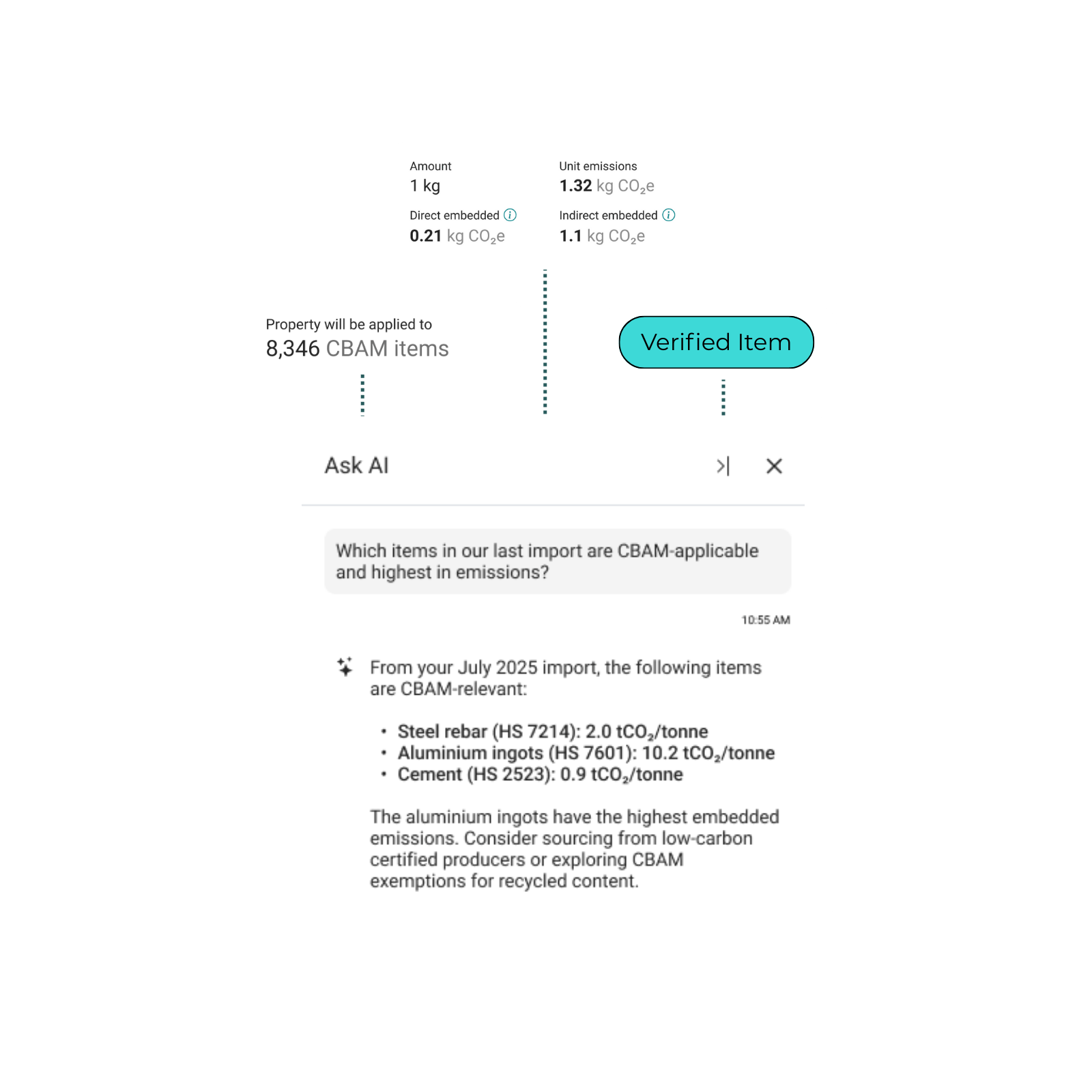

CBAM reporting deadlines are approaching and errors can cost millions. Carbmee’s Environmental Intelligence System (EIS™) gives you complete control over compliance. Built on the Carbontology™ data foundation, our AI automates emissions data collection, ensures audit-grade accuracy, and generates submission-ready CBAM reports in weeks and scale.

Trusted by leading enterprises

5.8Gt CO2e under Management

Is your CBAM strategy built to evolve, not just report?

Understand how CBAM impacts your imports, costs, and profit margins. Fill out the form to speak with our compliance experts and future-proof your strategy.

AI-Powered CBAM Solution for Fast, Audit-Ready Compliance

with the precision of your ERP

- Stay ahead of CSRD, EUDR, CBAM and execute your carbon reduction strategy in one platform

- Benefit from AI-powered agility with the precision and reliability of your ERP

- Automate reporting and cut compliance costs, and reduce regulatory risk with precision

- Break down products, suppliers and sites to turn compliance into real business value

Environmental Intelligence,

Engineered for Business

From emissions reporting to operational results: one platform to drive environmental ROI.

We help you to reduce cost, risk, and carbon at scale by embedding real-time environmental intelligence into your core business systems.

Learn MoreStart Your CBAM Compliance Journey Today

- Achieve data readiness in days

- Complete software integration and validation in weeks

- Ensure timely and accurate submissions to meet EU CBAM requirements

How Our Customers Are Leading the Way

Real Stories, Real Impact

Future-Proofing Global Supply Chains: Maersk and Carbmee Unite Efforts to Drive CBAM Compliance and Support Emissions Data Accuracy and Reporting Read more

Read more

Read more

Read more

KWS achieves complete transactional scope 3 carbon transparency and CSRD readiness with carbmee EIS™ Read more

Read more

Read more

Read more

Ravensburger achieves carbon transparency for Scope 3 emissions in 3 weeks with carbmee EIS™ Read more

Read more

Read more

Read more