Introduction

For decades, procurement and supply chain leaders have calculated landed costs using four familiar dimensions: purchasing price, tariffs, insurance, and shipping. These factors determined the true cost of acquiring goods and materials across borders.

But the world has changed. With rapidly evolving climate regulations, a fifth dimension has emerged—emissions-related costs.

This new cost factor is no longer optional to track. It’s a material risk to your bottom line, your compliance status, and your competitive advantage. Managing carbon proactively—rather than reactively—is now a necessity.

Try the Carbmee Carbon Cost Calculator to estimate how carbon pricing could impact your next procurement decision.

What Is the Fifth Dimension of Landed Cost?

In today’s carbon-conscious economy, emissions-related costs include:

- The price of carbon under regulatory schemes (e.g., EU ETS, CBAM)

- Fines or penalties for non-compliance

- Administrative costs of reporting and mitigation

These costs apply to a growing share of internationally traded goods and are especially relevant for industries with carbon-intensive inputs—like metals, chemicals, or cement.

Why You Must Act Proactively—Not Reactively

Some companies are treating carbon like a financial hedge—calculating the risk of being fined versus the cost of upfront compliance. While this may seem cost-effective in the short term, the regulatory landscape is tightening fast.

Acting only once fines or price hikes occur will leave you exposed to unpredictable financial risk, reputational damage, and supply chain disruption.

A proactive approach involves assessing carbon exposure continuously, then building mitigation into your procurement strategy. This includes:

- Choosing lower-emission suppliers

- Anticipating carbon price increases

- Negotiating long-term contracts that account for carbon costs

- Investing in emission-reduction initiatives across the value chain

Book a demo with Carbmee to see how your emission and pricing scenarios can be modeled in detail across suppliers and regions.

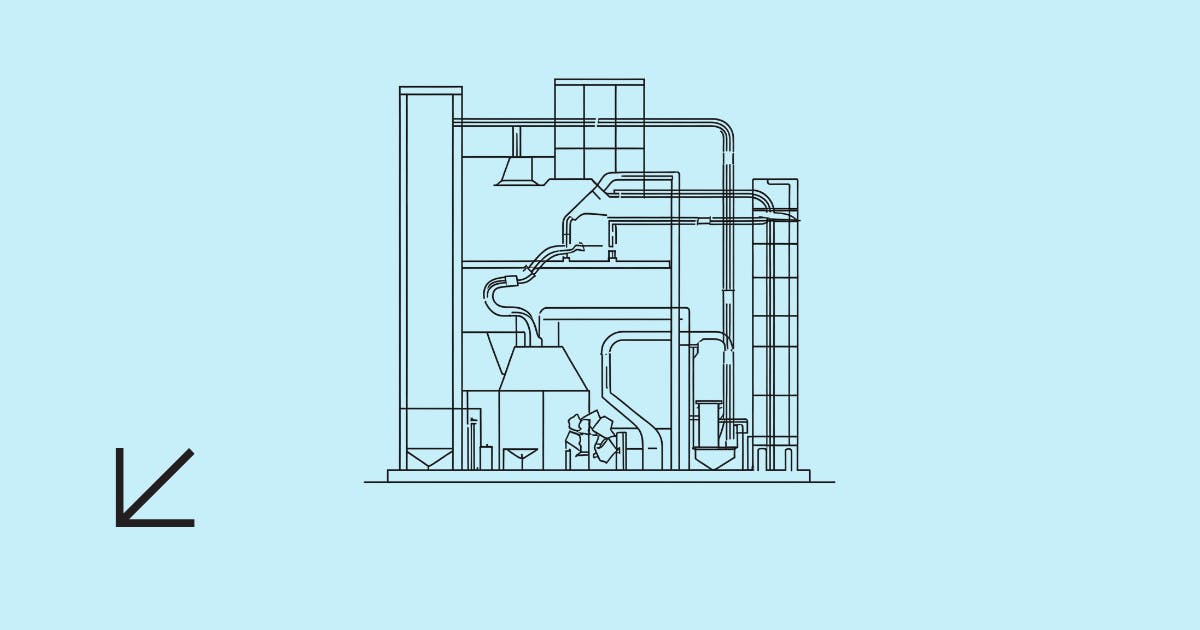

Real-World Example: Steel Procurement in Machinery Manufacturing

Consider a machine manufacturer that sources large volumes of steel. Typically, purchasing makes up 60% of their turnover. Of that, around 15–20% is linked to goods affected by carbon-intensive regulations such as CBAM (Carbon Border Adjustment Mechanism) or other regional carbon pricing schemes.

Steel is a prime example. Producing one ton of steel emits around 2.6 tons of CO₂. With carbon prices projected to hit €60 per ton of CO₂ in 2026, this could translate into an additional €156 per ton of steel purchased—a non-trivial cost when procurement is in the tens of thousands of tons annually.

Companies that fail to account for this now will face sharp margin pressure and possibly struggle to pass on these costs downstream.

Three Strategic Recommendations for Procurement Leaders

- Incorporate Carbon Pricing into Supplier Evaluation

Add carbon intensity as a core KPI. Engage suppliers on emission transparency and reduction efforts. - Model Future Landed Costs with Carbon Included

Use digital platforms like Carbmee to simulate landed costs under multiple carbon scenarios. Scenario planning is essential to risk mitigation. - Educate Stakeholders on Carbon Risk

Finance, compliance, and operations teams need to understand how carbon costs evolve. Build alignment on long-term investment in decarbonization.

Watch the video “Carbon is the New Currency” by Christian Heinrich, CEO of Carbmee, for insight into how emissions will shape the economics of global supply chains.

To turn emissions from cost centers into value drivers with measurable business returns, access the Carbmee x Verdantix Verified Value Study. It highlights how leading enterprises are unlocking real ROI through carbon transparency and data-driven decision-making.

Final Takeaway

Carbon pricing is becoming as fundamental to procurement planning as tariffs or freight. The companies that succeed in this transition will be those that recognize emissions as more than a compliance issue—they are a cost, a risk, and increasingly, a strategic lever.

Now is the time to embed carbon intelligence into procurement processes—before reactive penalties turn into missed opportunities.