Verified Results. Real Impact.

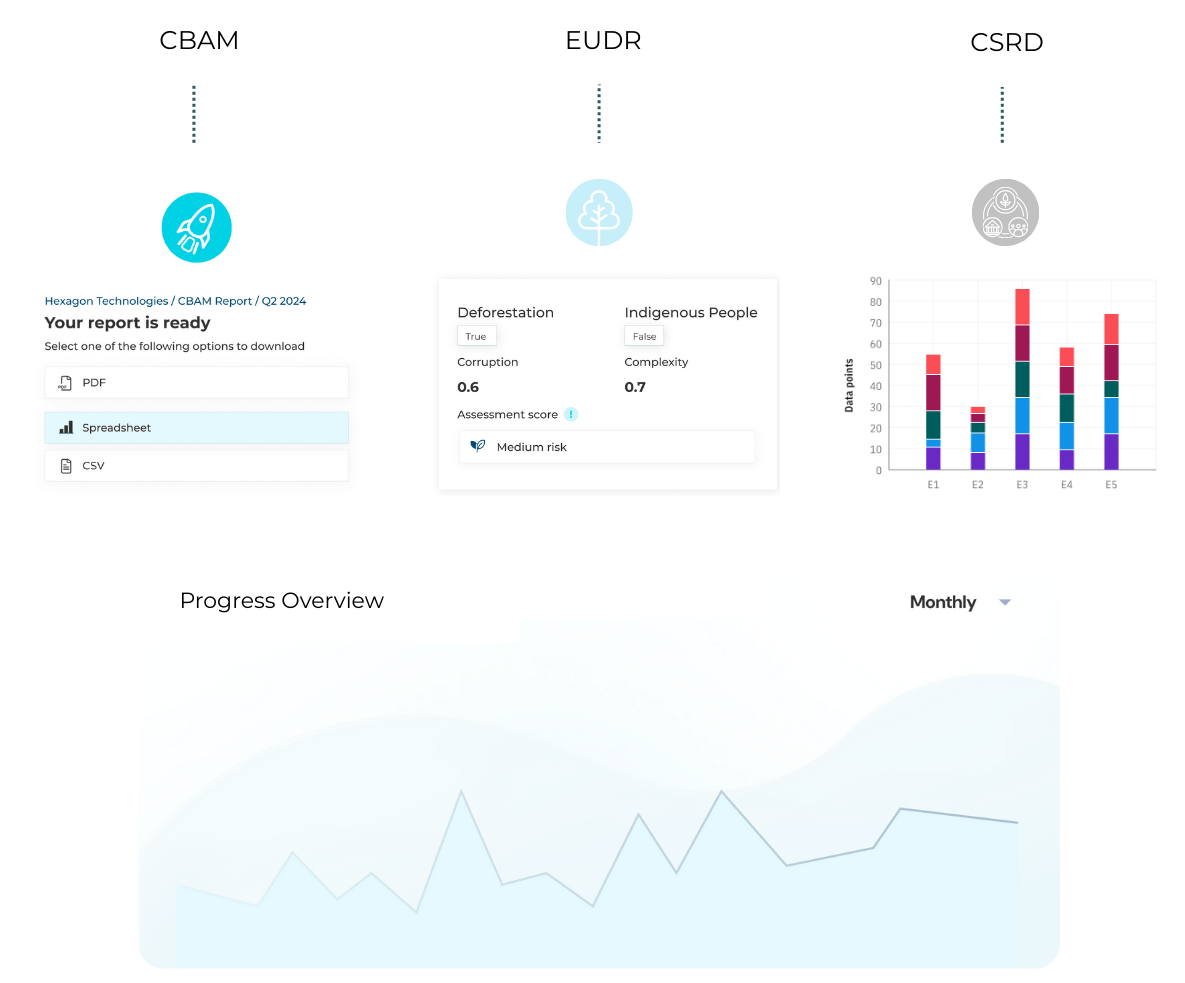

“Navigating the complex CBAM regulation is a major challenge for many of our global customers. Ensuring compliance requires deep regulatory insight, trade data management, and a scalable digital solution for emissions calculations."